Stock volatility calculator

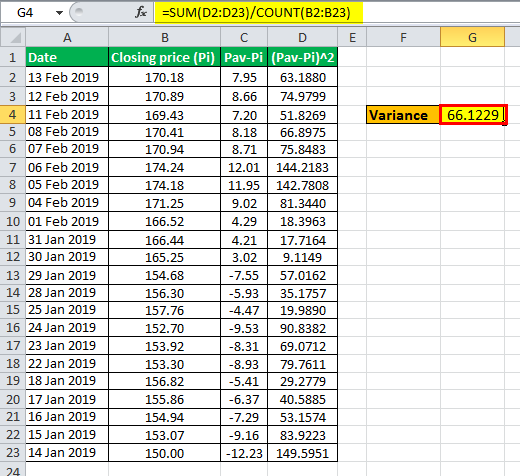

Calculating Volatility in Stock Market Volatility can be calculated with the help of variance and standard deviation Standard Deviation Standard deviation SD is a popular statistical tool. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

How To Calculate Volatility In Excel Finance Train

Apart from this you also need the volatility value for any stock.

. The following steps can be followed when calculating volatility through determining the standard deviation over time. Ad Learn More About American Funds Objective-Based Approach to Investing. You get this value from.

Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Provide a standard deviation the number of periods used to compute the standard deviation and the timeframe and well convert your. The Historic Volatility Calculator will calculate and graph historic volatility using historical price data retrieved from Yahoo Finance Quandl or from a CSV text file.

This is a free spreadsheet that downloads free historical stock data from the Yahoo database into the spreadsheet and calculates the historical or realized. Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option. Ad Browse Discover Thousands of Book Titles for Less.

Build Your Future With a Firm that has 85 Years of Investment Experience. Black Scholes model assumes that. The relative rate at which the price of a security moves up and down.

Stock Volatility Calculator v1. Customizable Tools for Your Strategy. The risk neutral probability is.

Ad Powerful Platforms Built for Traders by Traders. Simply select a stock check all the populated fields choose a future date your forecasting volatility metric. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Ad Trade your view on equity volatility with VIX options and futures. If the price of a. Click picture below to.

Our Resources Can Help You Decide Between Taxable Vs. Collect the historical prices for the asset. The Probability Calculator can be useful for both stock and options traders alike.

Simply select a stock check all the populated fields choose a future date your forecasting volatility metric. Annualized Volatility Calculator By Standard Deviation. The Probability Calculator can be useful for both stock and options traders alike.

Ad Trade your view on equity volatility with VIX options and futures. This calculator gives the risk neutral probability that a stock with the specified current price and volatility will be within the given price range at the specified date. Basic and Advanced Options Calculators provide tools only available for professionals - fair values and Greeks of any option using our volatility data and 20-minute.

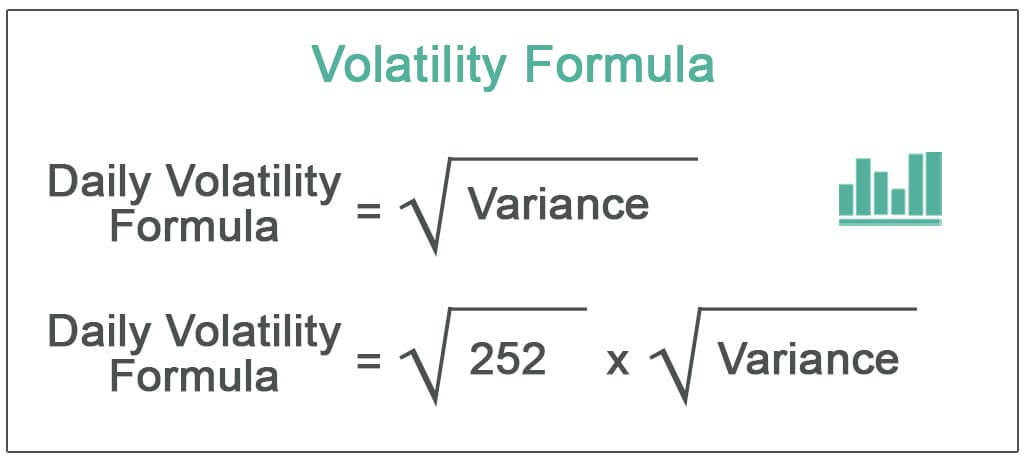

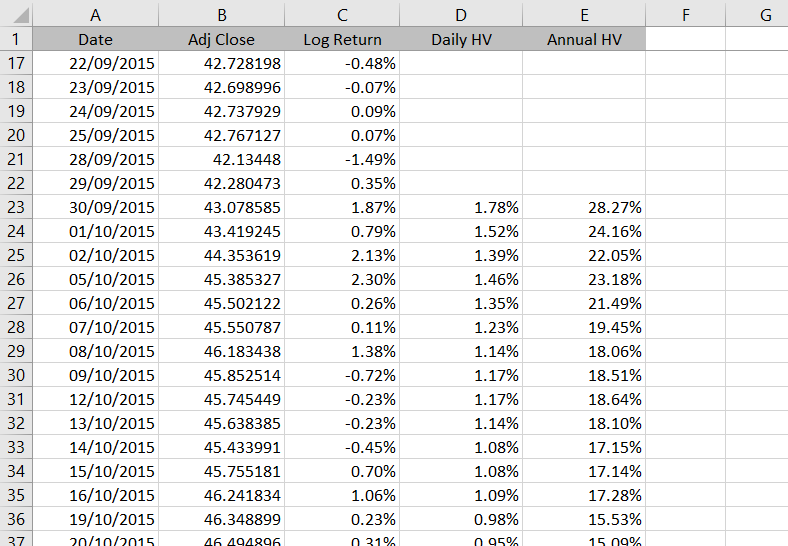

To use this calculator you need the previous day closing price and current days prices. Volatility is found by calculating the annualized standard deviation of daily change in price.

Volatility Formula Calculator Examples With Excel Template

The Options Industry Council Oic Technical Information

Volatility Formula Calculator Examples With Excel Template

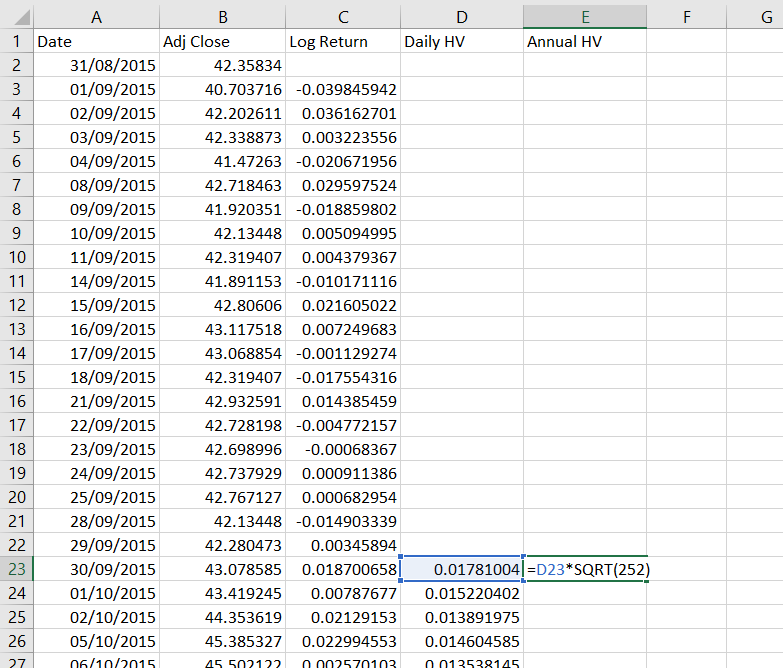

How To Calculate Historical Volatility In Excel Macroption

Price Volatility Definition Calculation Video Lesson Transcript Study Com

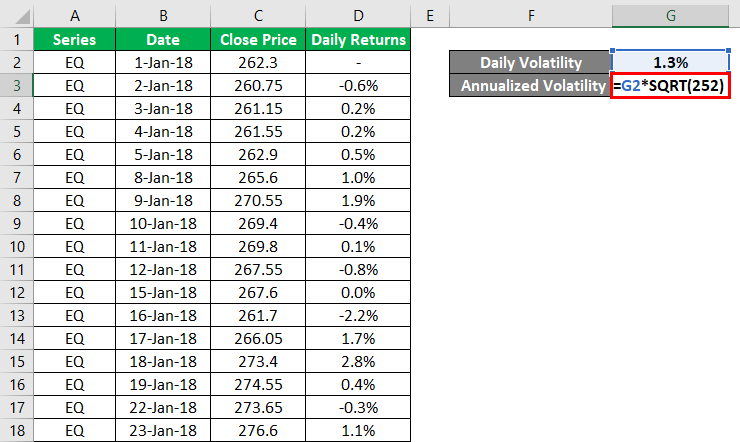

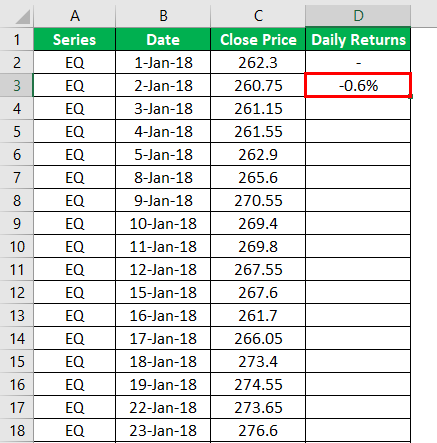

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

What Is Volatility Definition Causes Significance In The Market

Volatility Calculation Historical Varsity By Zerodha

How To Calculate Volatility Using Excel

Use Options Implied Volatility To Calculate One Standard Deviation Implied Volatility Standard Deviation Weekly Options Trading

Volatility Formula Calculator Examples With Excel Template

How To Calculate Volatility Using Excel

What Is Volatility And How To Calculate It Ally

How To Calculate Historical Volatility In Excel Macroption

Calculate Implied Volatility With Vba

How To Calculate Volatility Using Excel

Volatility Formula How To Calculate Daily Annualized Volatility In Excel